Oil Ain’t Tomatoes – Part I

Posted in Oil Prices, Other Current Affairs, United States on July 27th, 2008 by Jacob27 July, 2008

If I knew what will be the price of crude oil tomorrow, I would not be here, I be sitting down on my own Island in the South Pacific, sipping Chivas Regal and employ a ghost writer to write my blogs. Seeing that I don’t know what will be the price of crude oil tomorrow, I will stay in Sydney, stick to tonic water and rant on by myself.

As someone who studies the subject formally I can tell you that Economics is the art (it certainly not a science) that provide excuses as to why the last economic prediction did not work. (Have you heard about the convention of clairvoyants that was cancelled due to unforeseen circumstances?)

Further, I suggest to you that anyone who KNOWS how to bring down the price of oil is a liar or a fool, myself included. Thus I try to shade some light on the issue that may assist you interpreting events and statements irrespective of their political origin.

What Is Crude Oil?

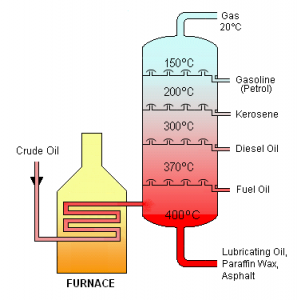

Crude oil is a mixture of petroleum products that is separated by a process we call refining (or distilling). The output of oil refining is called (petroleum) products Crude oil is useless unless it is processed The relative amount of products in a barrel of crude oil, known as the characteristics of crude oil cannot be changed for a particular oil but it varies greatly between oil wells, in fact each well has it own “finger print” often , by identifying the well such spill has come from.

Light crude oil refer to oil with high content of “light” (or white) products such as petrol (gasoline), aviation fuel, kerosene etc. whilst heavy crude refer to oil with higher content of diesel, heating oils, fuel oil down to waxes and asphalt.

Traditionally oil is traded in barrels. A barrel is a volume measurements, it equates to 42 US gallons (about 35 imperial gallons or 159 litres). A barrel of light crude weighs less than a barrel of heavy crude oil, hence it is said to be “light”.

Sweet crude oil refers to its acetone-like smell indicating low sulphur content (less then 0.5%). Oil with high sulphur content (Sour) has a vile smell (a Middle Eastern public toilet would smell like a rose garden by a comparison, believe me, I smelled them both). Getting rid of sulphur is expensive, thus crude oil with higher sulphur content ought to be cheaper as it is considered inferior. Over a short period refineries are locked into the type of oil they process, thus forced into individual sources that maintain similar characteristics of oil that is compatible with their refining abilities. Lesson one: Crude oil is not an homogeneous product.

Refining Oil

Oil refining is a (chemical) contentious process, meaning it runs 24/7 and cannot be stopped. Restarting a refinery takes about 7-10 days until it reaches full production, at a daily cost of $100/200,000 (depending on size), therefore it is designed around the concept of continuous flow of stockfeed (crude) oil and products.

A refinery that is in danger or running out of crude oil will pay just about any price for a shipment of crude to avoid shutting down heavy costs. Similarly a refinery that is running out of space to store its products will give it away at bargain base prices just to make space for more product rather than to shut down production. The exact opposites are also true in relation to storage space.

Lesson two: the spot prices for oil and its products are influenced more by storage space than by any other factor, including supply and demand. This is why oil “inventories” are crucial to oil prices, this is the theory anyway.

I qualified the theory because inventories alone do not tell the whole story. Right now crude oil inventories around the world are high, in fact, despite what you are told, there is NO SHORTAGE of oil at present which should result in lower demand and current low prices, yet it prices continue to soar.

Production Allocation And Pricing

With the exception of all western countries, all the global oil production (getting oil out of the ground) facilities are state owned. As a rule, oil is sold in Production Allocations, sometimes referred to as allotments or vouchers, to a panel of buyers, generally comprises of oil companies and oil traders.

Oil allocations came into the news when Saadam Hussein’s abuse of the “Food For Oil” plan were exposed whereby “vouchers” were given out to 270 people and organisation, with no relation to the oil industry, as bribes or payment for “favours”.

To be on the “panel” of Saudi Aramco ( to have an Aramco registration number), one must be a refinery or show has a Processing Agreement with a refinery. Traders may receive allocations if their allocation is going to a refinery not already receiving Saudi oil by other allocations. Allocation may be for a period or spot, it include total quantity, shipment ports and quantities, approximate shipment dates and price. Price can be nominal, e.g. US$ 130 per barrel, or, most likely, by a reference to Crude Oil Benchmark also known as Price marker, e.g. West Texas Intermediate (WTI) less $1.00.

With the exception of posted prices that are set arbitrarily, benchmarks are price indicators based on market trading information, take account of quality, gravity and place of delivery. Brent, Tapis, West Texas Intermediate (WTI), OPEC Basket, Dubai Mercantile Exchange (DME). In the USA domestic crude is traded by reference to WTI, Rotterdam Brent is used by in Europe and the Tapis is used mainly in the Far East.

An example for an allocation is 1 million barrels (about 140,000 tonnes) Saudi Light Crude Oil (SLCO) per month, ex Ras Tanura (an oil port in Saudi Arabia), in monthly shipments at the 3 days average Brent Rotterdam (price) less US$3.00 as at date of shipment and other details

This means that the actual price of wet barrel (oil that is physically delivered, as distinct from “paper” oil) is not known until it is taken possession of by loading it onto a ship, rail wagon or pushing it into a pipeline. That can be literally months after it was bought and at a very different price that the one ruling at the time of purchase.

The market

If I promise you that I shall sell you next year tomatoes at next year price, you would not buy them from me because you have no reason to commit yourself now to next year prices, whatever they are. However, if I promise to sell you next year’s tomatoes crop at this year price (plus a small premium) AND give you the option whether to take those tomatoes off me or not (should the ruling market price is cheaper than my price), you may take me up on my offer, after all you have little to lose – If the price at your supermarket is a lot higher then mine, you buy from me, if it is a lot cheaper you will buy is from the supermarket, as simple as that.

Not to make too finer point on the issue, this is how a future market works, whether it is shares futures or commodities’, including oil. According to the New York Mercantile Exchange (NYMEX) rules crude oil is traded in 1,000 barrels, monthly (executable on the last trading date of each calendar month) for the current year and the following five years, after which contract are six monthly (June and December) up to 9 years into the future, or in the words of NYMEX:

Crude oil futures are listed nine years forward using the following listing schedule: consecutive months are listed for the current year and the next five years; in addition, the June and December contract months are listed beyond the sixth year. Additional months will be added on an annual basis after the December contract expires, so that an additional June and December contract would be added nine years forward, and the consecutive months in the sixth calendar year will be filled in.

You can have the right for a contracted quantity of oil (in 1,000 barrels multiple) for next months, three, 6 or twelve months, up to 2 years if I’m not mistaken.

All you have to have is 10% of the value of the contract up front, the 90% is payable on delivery, if you ever decided to take it. Should you fail to take delivery, you would lose your deposit.

Under certain trading rules, you may of course sell your future entitlement any time before the due date. That allows “paper oil” to be bought and sold many times over, by oil traders. Those trader who buy oil in the hope a price rise are called speculators. Speculation, per se, is not a bad thing provided that all the players in the relevant market are playing on the same levelled field and abide by the same rules – I suggest to you that this is not the case when we talk oil.

Tomatoes and oil

Suppose you trade in tomatoes and bought a contract for next season at a price. Next seasons tomatoes’ price will be determined by supply and demand when the time comes, a glut of tomatoes will produce a reduce price whilst a shortage will produce an increase in price. Thus if the season’s price is under your contract price, you will not execute you ‘future contract’ but simply buy your tomatoes spot. If the season’s price is high, you would execute you contract and sell your tomatoes with a great profit.

Now suppose the largest supermarket chain in your country control most of the tomatoes market by per-buying the crop from the growers and now suppose that that chain offer you a “future contract” on tomatoes, would you buy one?

Under such conditions you would not but tomatoes future in a month of Sundays because the market is already controlled by a player in the market who can dictate the price, no matter what you do, you will always lose.

This is basically the case with oil, and oil futures in particular. The market is controlled by oil producers, who are largely a cartel thus in a substantial control over the market. Buying oil futures from the oil producing countries is like buying tomatoes futures from Wal-Mart, in USA, Tesco in the UK or Woolworth in Australia, you would not do it!

(Continues in Part II)

© Copyrights Jacob Klamer 2008, all rights reserved